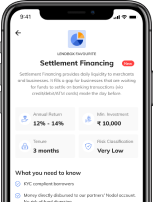

Earn up to 14% p.a.

with Lendbox

High quality lending with consistent returns - now available for the Indian retail lenders. Curated options for every risk appetite, minimum lending ₹10,000.

How it works

Open an account in 5 minutes

Register

We only need your PAN card and an address proof

Choose Borrower category

Select your preferred borrowers based on risk categories, loan tenures and other parameters

Deployment of Funds

Make a transfer and deploy into your selected borrowers

Receive repayment based payout

You can re-lend by transferring your amount

Time Tested

The ultimate boost for your lending portfolio

Founded in 2015, Lendbox has helped unlock unprecedented returns for its lenders. We achieved regulatory compliance from RBI in 2019 and are headquartered in New Delhi.

Why Lendbox

We offer India’s largest stack of retail lending

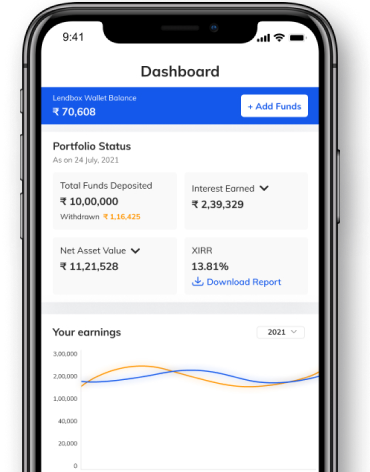

Everything you need to control your lending is available in a single app

Wide range of financial products based on your preferences. Make informed decisions and retain complete control of your portfolio.

A dedicated relationship manager will help you make better financial decisions and grow your money.

Our lenders can choose from India’s top quality borrowers

Partner with us

Help your users lend their money

This is why thousands of our Wealth partners from all over India love and trust Lendbox.

The whole idea behind this is great and makes lending a lot more easy. I appreciate the transparency provided in the repayment history. I can even read notes that the Lendbox team has written.

Dr. Karishma Khosla

New Delhi

The whole idea behind this is great and makes lending a lot more easy. I appreciate the transparency provided in the repayment history. I can even read notes that the Lendbox team has written.

Any questions?

If you need help getting started, managing your portfolio or if you’re wondering whether Lendbox is the right choice for you, these frequently asked questions may help.

How does Lendbox manage the risk of default?

Lendbox follows a robust credit assessment policy to bring only the most creditworthy borrowers to the platform. We categorize borrowers by risk in a manner that reduces the risk of capital erosion for our lenders.

How much fees will I have to pay?

Platform fees for this issue would be deducted from the 1st EMI repayment and the net amount will be settled into your bank account.

What if Lendbox closes its doors?

We’ve been around since the beginning of P2P lending in India, and plan to stay around for a long, long time. If due to unforeseen circumstances, we are forced to close our doors for business, all loan agreements will still be valid as they have been signed between the respective lenders and borrowers.